Covered call ETFs have become popular due to their high yields and monthly payouts. There’s a lot of appeal in those things. There’s also skepticism. They are legitimate investment vehicles using a legitimate investment strategy—covered calls. That said, they have strengths and weaknesses, as all investments do. Understanding them is the key to using them appropriately and determining how they might fit into your portfolio. I will attempt to explain them in this post. This post is not intended to be a detailed explanation of calls; it is intended to give you a high-level understanding of calls to help you understand the ETFs that use calls. To thoroughly understand calls, much more is needed than what I have written below.

Derivatives

Calls are a type of option, and options are a type of derivative. A derivative is a financial instrument that derives its value from another instrument. The image below shows the hierarchical relationships of different derivatives to help you visualize where calls fit in (note: this is not a complete list of derivatives, just a sample).

Derivatives began with farming in the U.S. and exist to hedge risk. Farmers used them to lock in prices today for crops they were going to sell in the future. But to hedge risk, you need speculators who take on the risk. Speculators help keep the market liquid with the use of derivatives, and liquidity is an important part of keeping markets efficient. Therefore, derivatives are gambling with an overall good to society: liquidity and hedging.

Calls

Options are contracts that are sold by one party and bought by another. Buying a call option gives you the right to buy an asset (e.g., stock or ETF) at a specific price during a specific time period. Conversely, if you sell a call option, someone else has the right to buy an asset from you at a specific price during a specific time period. Some call terminology is listed below.

- Strike price (AKA exercise price)

- The specific price that you buy the right to buy the asset at.

- Premium

- The price you pay for the option; the price of the contract.

- Spot price

- The price of the underlying asset.

- Expiration date (AKA expiry)

- The specific time period the call option is good until.

- Writer

- The person who sells (AKA writes) a call option.

- Buyer

- The person who buys a call option.

- Out-of-the-money (OTM)

- When the spot price is less than the call strike price.

- In-the-money (ITM)

- When the spot price is greater than the call strike price.

- At-the-money (ATM)

- When the spot price is equal to the call strike price.

Call Example

Here is a simplified example of a call contract. Note that each call contract is for 100 shares, so the premium in this example would be multiplied by 100.

The current price (spot price) of Amazon stock (AMZN) is $184. The writer sells a call option on AMZN with a strike price of $200 and premium of $4.65 (the buyer pays $4.65, and the writer collects $4.65). Expiry is in 5 weeks. AMZN price goes up to $210 (in the money) by expiration. The option is exercised, and the writer must sell 100 shares of AMZN to the buyer at $200 (despite the fact that it is currently trading at $210). If the writer does not own the stock they have to go out and buy 100 shares at $210, then sell it to the option buyer at $200.

To avoid the loss of having to buy high and sell low, the option writer can do a covered call. This is when they buy the stock first (so they are covered), then sell the call option. If they had done so in our previous example, they would have bought AMZN at $184 (instead of $210) and sold it at $200. In this way, they would have still made a profit, but they would’ve put a cap on the upside (since the stock has to be sold at $200). But they also earned the premium of $4.65.

If AMZN was only trading for $190 (out of the money) at expiry, the option would not be exercised. The writer would not have to sell 100 shares of AMZN, the writer would have made $4.65 from the premium, and the buyer would have lost $4.65 from the premium. In this way, a covered call can boost the return in a relatively flat market by providing additional income.

If the price of AMZN had actually gone down to $170, then the option premium would have reduced the downside for the writer, therefore acting as a hedge.

The ETFs

With that basic understanding of covered calls, let’s look at the ETFs that use this strategy to generate monthly income. There are many different covered call ETFs, and they use different underlying assets, but most of them use either the S&P 500 or Nasdaq-100. I prefer the Nasdaq-100 for covered calls, because the Nasdaq-100 is heavily weighted in volatile tech stocks, and these generate higher premiums, all else equal. My favorite three Nasdaq-100 covered call ETFs are listed below.

- GPIQ – Goldman Sachs Nasdaq-100 Core Premium Income ETF

- JEPQ – JPMorgan Nasdaq Equity Premium Income ETF

- QQQI – NEOS Nasdaq-100 High Income ETF

GPIQ

GPIQ is my favorite of the three. It has the lowest expense ratio of all covered call ETFs that I’ve seen: 0.29%. It buys a portfolio of stocks that replicates the Nasdaq-100 index, then sells at-the-money calls against Nasdaq-100 underliers, such as ETFs like QQQM. The call coverage (meaning how much of the portfolio it writes calls against) is between 25-75%. The lower coverage allows GPIQ to have more capital growth potential. The stated goals of the fund are to provide a stable rate of income while capturing the majority of the return and risk of the Nasdaq-100.

JEPQ

JEPQ has a relatively low expense ratio of 0.35%. It invests in an actively managed portfolio of equities comprised mainly of those included in the Nasdaq-100 but does not necessarily mirror the index like GPIQ does, and it will invest in equities that are not included in the Nasdaq-100. JEPQ does not actually use covered calls to generate the income. Instead, it uses equity-linked notes (ELNs) that are designed to mimic the characteristics of out-of-the-money calls. ELNs are another type of derivative—debt instruments issued by banks. Up to 20% of the portfolio is covered with ELNs and by keeping the coverage low, it seeks to allow room for capital appreciation. The fund seeks to reduce volatility relative to the index. The stated goals of the fund are to generate current income while maintaining prospects for capital appreciation.

QQQI

QQQI is very interesting to me. It has the highest expense ratio of 0.68%. It normally invests in equities that replicate the Nasdaq-100 index but may at times use a “representative sampling” strategy that does not exactly mirror the index. It sells at-the-money or near-the-money calls on up to 100% of the portfolio. This combination of ATM calls as well as 100% coverage generates higher dividend yields than the others, but it also caps the capital appreciation significantly. These next two points are where it gets interesting. First, it sometimes buys out-of-the-money calls so they can get back in on the growth if stock prices move up really fast. It does so in a way that the premium received from the written ATM call is greater than the premium paid for the purchased OTM call (generating a net-credit). Second, it generates income in a more tax efficient manner than the others by selling calls against the index itself rather than index underliers such as ETFs. This post isn’t about tax law, so in short: there are IRS rules that allow this call structure to be taxed at a lower rate. The stated goals of the fund are to generate high, monthly income in a tax-efficient manner while allowing potential for capital appreciation.

Strategy Summary

To me, the takeaways from the strategies are as follows: GPIQ should have the most consistent distributions (since that’s a stated goal), GPIQ and JEPQ should have the most capital appreciation (due to less call coverage), QQQI should have the highest yield (due to most call coverage) and highest downside protection (due to more income), and QQQI will be the most tax efficient.

Performance Metrics

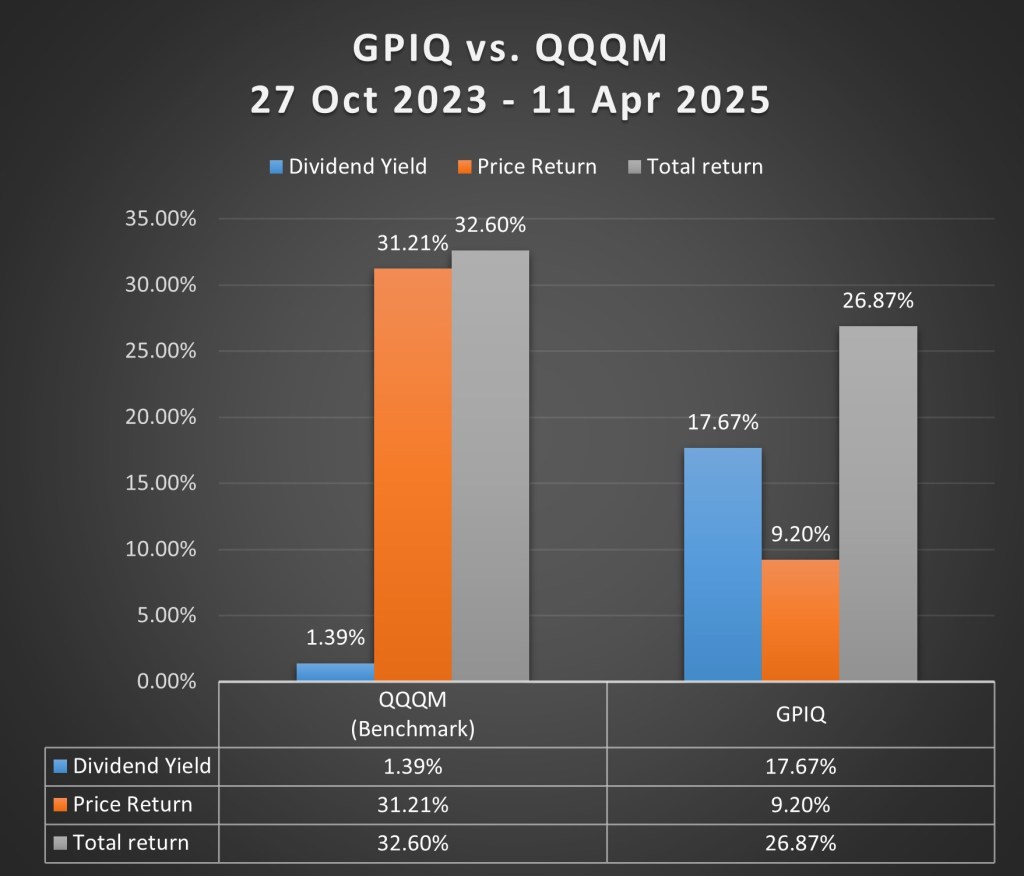

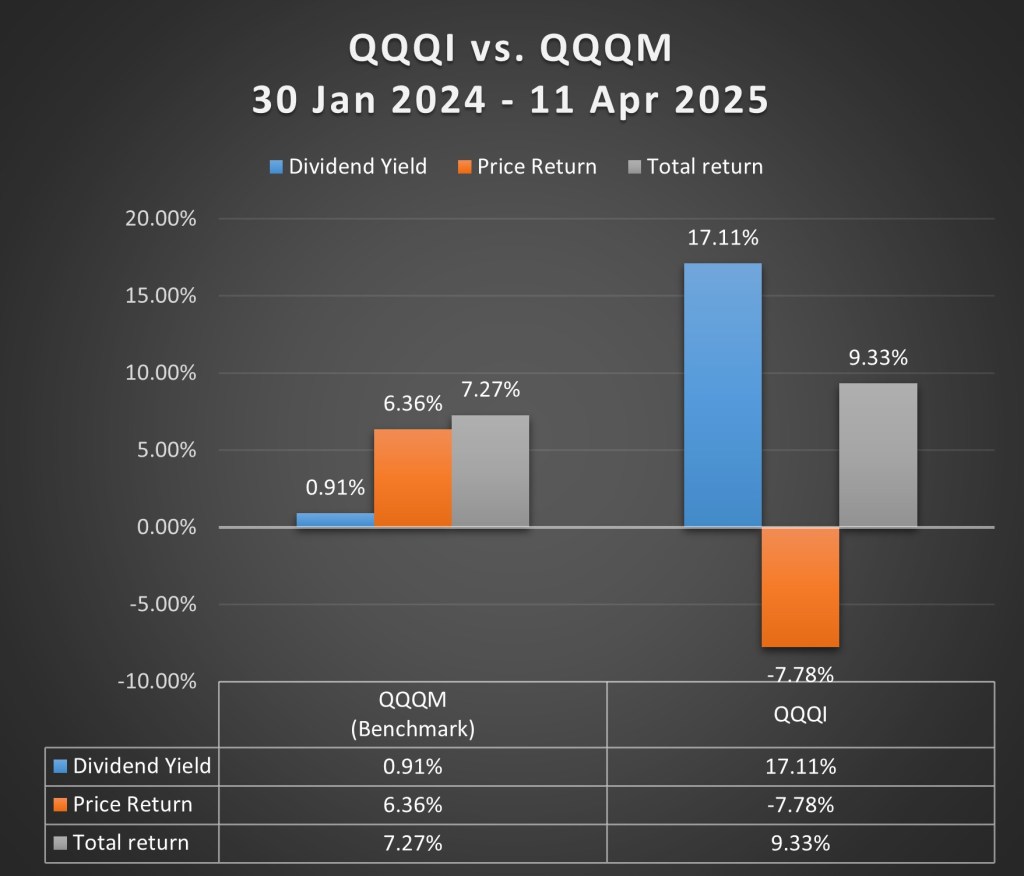

Now let’s take a look at different aspects of how these three ETFs have performed. An important thing to remember is that total return is made up of two components: dividend yield and price return (AKA capital appreciation). I will look at both components of return and compare performance to QQQM, which is a Nasdaq-100 ETF (benchmark index, without covered calls).

Performance Since Inception

All three ETFs have different inception dates. The charts below show how each has performed against the index since its own inception date.

Performance From Common Date

QQQI is the newest of the three funds. The chart below shows the three funds’ performance since QQQI’s inception, the earliest date all three ETFs existed simultaneously.

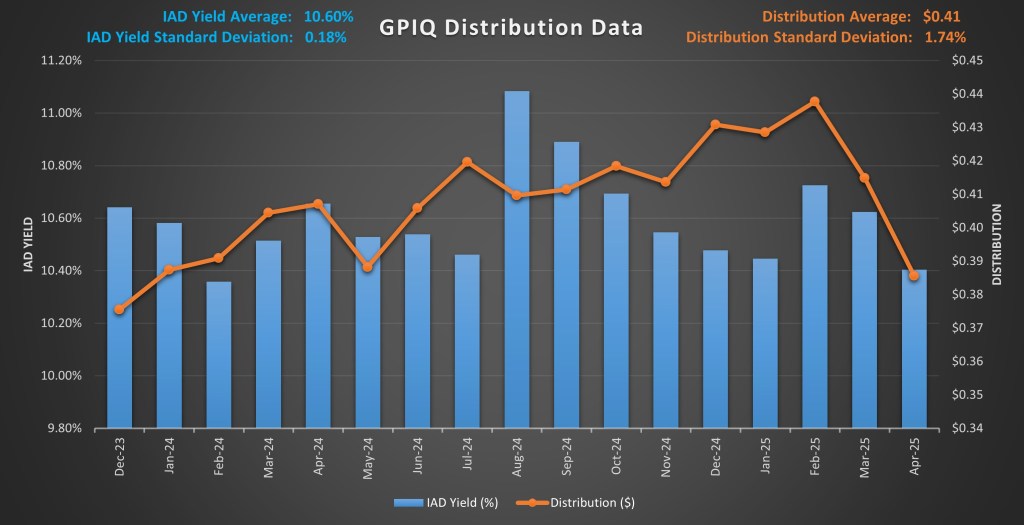

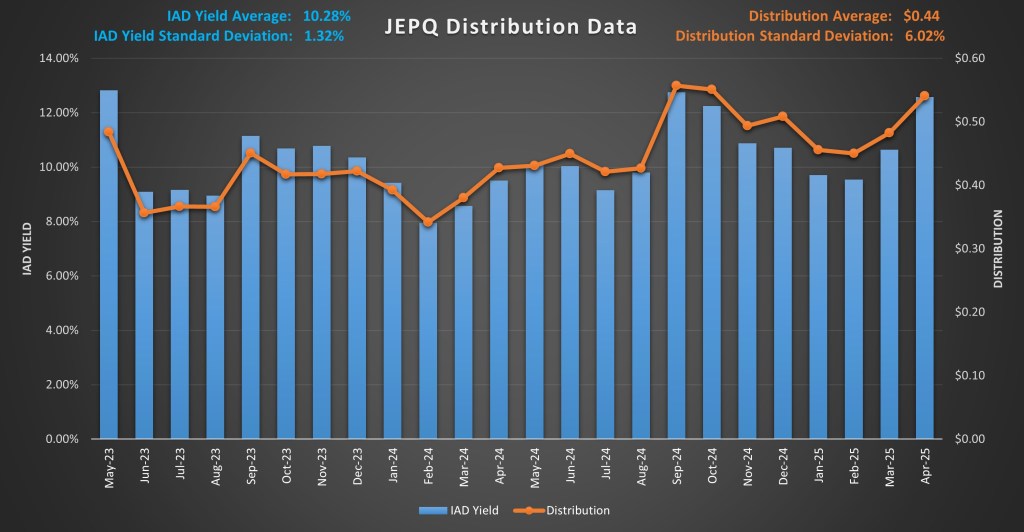

Distribution Consistency

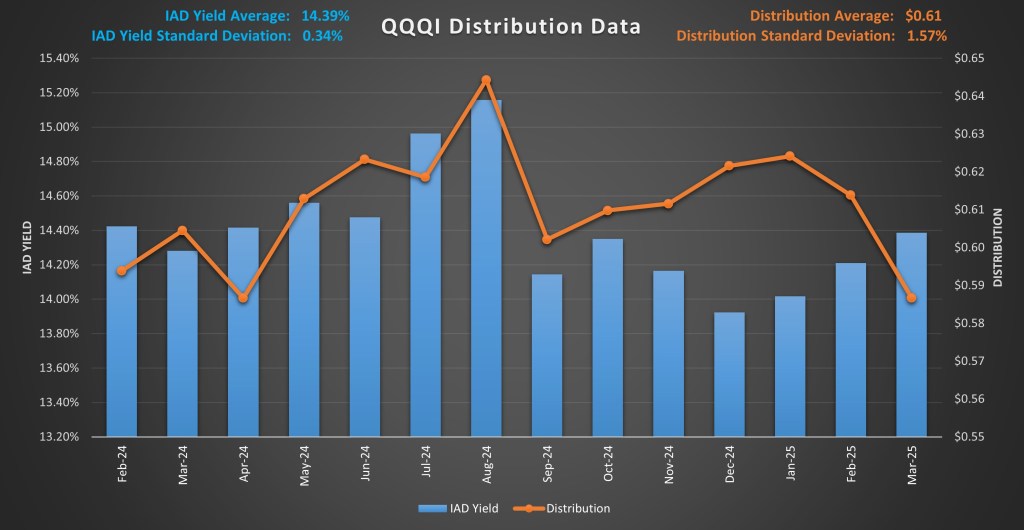

The charts below will look at the consistency of monthly distributions, as well as consistency in the Indicated Annual Dividend (IAD) yield. Payout consistency is important for being able to reasonably forecast your monthly income.

Downturn Performance

With the ongoing market downturn caused by the trade war, I had the perfect opportunity to examine the performance of each fund in a down market. The chart below shows how each has held up against the benchmark since the beginning of the market drop.

Conclusion

Covered call ETFs are legitimate investments that have pros and cons. They offer high yields, monthly cash flow (without selling shares), downside protection, and possible outperformance in bear or flat market conditions. However, they cap the upside during bull markets, are a tax drag, have limited history, and are unlikely to grow income if dividends are not reinvested (income growth is important because your income must outpace inflation).

Covered call ETFs can be part of a portfolio, but they should not be the entire portfolio. There are roles for them to play. In addition to hedging against flat or bear markets, the immediate, monthly income generation can hedge against job loss by providing another source of income. They should always be paired with other assets that will provide growth and growth of income, such as broad market ETFs like VTI and/or dividend growth ETFs like SCHD.

Not all covered call ETFs are created equally. The call structure and call coverage can drastically change how the fund will likely perform. It’s important to do your own research into these funds and ensure the one you choose aligns with your goals.

Note: In addition to the Nasdaq-100 covered call ETFs mentioned in this post, Goldman Sachs, JP Morgan, and NEOS all offer covered call ETFs based on the S&P 500 as well. Those ticker symbols are GPIX, JEPI, and SPYI.